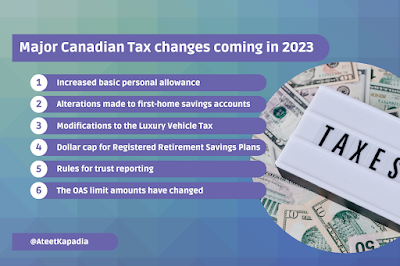

We have seen extreme economic instability over the past few years. In COVID-19, Ateet Kapadia explained that a significant inflation rate has already been seen. Following that, there are other adjustments to the tax amounts that have been raised for 2023. He talked about several significant individuals you should be aware of in 2023.

Increased basic personal allowance-

The non-refundable tax

credit is available to everybody who pays income tax in Canada. The fundamental

justification for this partial decrease is that those who pay taxes and earn

more than this baseline amount do so at a reduced rate. The goal is to offer

full income tax deductions to those who earn less than a specific threshold.

According to the federal budget released in December 2019, it is proposed to

alter the Income Tax Act so that the basic personal exemption amount would rise

to $15,000 by the year 2023.

Alterations made to first-home savings accounts-

Ateet said that while

most people won't be affected by this development, those wishing to purchase a

new home for themselves will. As with the initial home savings account, a

deduction of up to $40,000 will be allowed up to almost $8000 per year starting

in 2023. This impacts people starting in 2023 and will also have an impact on

those who are constructing homes for the first time.

Modifications

to the Luxury Vehicle Tax-

As to recent

regulations, starting in September 2022, cars costing more than $100,000 will

be subject to a tax equal to 10% of that item's worth. However, if the person buying

a used car, they would often not have to pay the luxury tax, even if the cost

was over $100,000.

The

dollar cap for Registered Retirement Savings Plans has risen-

According to Ateet Kapadia, the

yearly RRSP ceiling, which was around $27,800 in 2021, has now raised to

$29,210. According to the regulations, everyone older than 17 years old is

eligible for the RRSP deduction restrictions. In addition, if your

contributions are beyond your $2,000 RRSP deduction limit, you must pay an

additional 1% monthly tax.

Rules for trust reporting-

When someone does an

estate freeze, Ateet explained. A legal strategy called an "estate freeze"

is used to lock the current worth of a capital asset for one person so that any

future appreciation will benefit someone else. This is typically done to lower

any unpaid estate taxes. Since 2021, trusts will no longer be exempt from

filing returns if there is no tax due and no distribution of assets has been

made by the trust. Every trust will have to submit a return starting with the

2023 tax year.

The OAS limit amounts have changed-

The purpose of the OAS

is to provide retirees with a source of income, but if their income exceeds the

federally imposed limit, their benefits may be decreased or even terminated

depending on the information the Canada Revenue Agency has access to (CRA).

Conclusion-

The CRA is in charge of

ensuring that everyone files their taxes in accordance with the law. If you are

employed in Canada, paying taxes is a given. Taxes for self-employed people

operate differently from taxes for people with regular jobs. A non-resident of

Canada will file taxes in a different way than a Canadian resident. You can

file your taxes appropriately using internet tax applications, or if your

circumstances are difficult, you could think about employing a professional in Canada for guidance and tips to keep informed regarding tax flow in Canada.