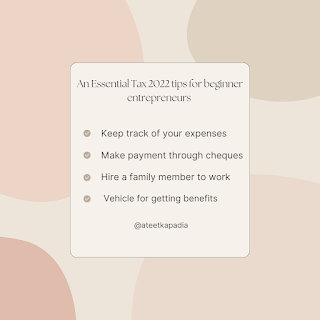

Every fledgling businessperson must at some point deal with taxes, which initially causes them confusion and difficulty. According to Ateet Kapadia, it frequently causes headaches for newcomers since they have to go through several formalities throughout tax season. In order for beginning entrepreneurs to understand the scenario and maintain track of the circumstances while also saving time and money on taxes, Ateet Kapadia elaborates on some tax suggestions based on his experience.

Keep track of your expenses-

According

to Ateet Kapadia, keeping track of all of your documents would make it simpler

for you to navigate and comprehend any circumstance with precise reports. Not

only does it save you time, but it also keeps you out of danger. For instance,

if you run a business or offer any kind of service. Your services or businesses

are often operated by staff. Typically, you have everyday costs. If you don't

keep a record and have a daily expense. You definitely have problems. You have

to pay higher taxes since your costs are not exact and are calculated based on

theories or assumptions. Having daily accurate records that are kept up might

easily prevent these situations.

Make payment through cheques-

As a

business owner, Ateet Kapadia said that using cheques is always a smart idea.

As a company owner, paying with a check rather than cash will always save you

taxes. Since you frequently face the danger of running out of receipts when you

make everyday payments. Since you often avoid running out of perks when paying

with cash, Additionally, if you use checks, you can provide the government with

a proper record of payment deductions. You may still save taxes if you don't

have a receipt since you have your chequebook to show the government your

records.

Hire a family member to work for you-

Ateet Kapadia

enlightens that you may increase the advantages by saving money on taxes if you

have family members who can assist with duties crucial to your business, such

as a youngster who can assist mow lawns as part of your lawn service.

Hiring a

family member allows you to minimize your taxable income by taking a business

deduction for the reasonable compensation you gave that person, which may also

allow you to avoid paying taxes on that income.

Getting a business vehicle for getting benefits-

It is usually preferable to purchase a car for use in regular company operations. He explained that an asset is shown in your worksheet when you buy a car, you gain from this. You can obtain a deprecation on it thanks to this. This helps your business run better while simultaneously reducing your tax liability.

Ateet Kapadia also answer some question for beginner entrepreneurs-

Q. What are the more benefits of hiring a family member?

A. He

explained that hiring family members might result in significant tax savings.

They could earn compensation on par with what other workers receive. If the

hired family members don't have any other means of support, the company will

pay them. As a consequence, they won't be obligated to pay taxes. Since the

salaries paid to the workers represent a cost to the company, they can be

subtracted from its taxable income, reducing the overall tax burden.

Q. How do limits on making the cash payment help in taxes?

A. He

described that setting a cap on payments made in cash is always a smart idea.

Since income tax forbids expenditure deductions when cash payments exceed the

cap amount. If possible, divide payments over a few days if there is just cash

available for payment.

Conclusion-

This

straightforward advice might be quickly used in your day-to-day business

operations. Because it will save entrepreneurs a great deal of time and prevent

problems. In order to reduce your tax liability and maximize your tax

deductions, it is thus wise to keep these ideas in mind that Ateet Kapadia

mentioned.

No comments:

Post a Comment